Filed under: Google (GOOG), Apple Inc (AAPL), Cisco Systems (CSCO), China

Sequoia Capital is a pioneer of the venture capital space, having invested in such game-changing companies like Apple (NASDAQ: AAPL), Cisco (NASDAQ: CSCO), and Google (NASDAQ: GOOG). No doubt, they’ve helped create many millionaires — and some billionaires. Sequoia Capital is a pioneer of the venture capital space, having invested in such game-changing companies like Apple (NASDAQ: AAPL), Cisco (NASDAQ: CSCO), and Google (NASDAQ: GOOG). No doubt, they’ve helped create many millionaires — and some billionaires.

Well, the same thing is now happening in China, although the wealth management business in the country is still in the early stages.

As a result, Sequoia wants to be a player and has invested several million for a 20% stake in Noah Private Wealth Management Centre, which is headquartered in Shanghai. With the cash infusion, the firm can expand into other cities as well as add new consultants and perhaps some tech systems.

It’s a very savvy move. And, yet again, it should result in a big payday for Sequoia.

Visit DealProfiles.com if you want to check out other recent venture capital fundings.

Tom Taulli is the author of various books, including The Complete M&A Handbook and The Edgar Online Guide to Decoding Financial Statements and The Edgar Online Guide to Decoding Financial Statements . .

Permalink | Email this | Linking Blogs | Comments

Share This

No Comments » No Comments »

Filed under: Analyst reports, Google (GOOG), Yahoo! (YHOO), Analyst initiations, Suntech Power Hldgs ADS (STP)

.gif) MOST NOTEWORTHY: Suntech Power, First Solar, Banco Santander, Internap and NetGear were today’s noteworthy initiations: MOST NOTEWORTHY: Suntech Power, First Solar, Banco Santander, Internap and NetGear were today’s noteworthy initiations:

- Merriman initiated shares of Suntech Power (NYSE: STP) with a Buy rating and believes the company is benefiting from strong worldwide demand for solar PV technology. The firm suggests a potential 12-month stock price range of $56-$64.

- Merriman also started shares of First Solar (NASDAQ: FSLR) with a Sell rating, as they believe the company’s market is limited to ground-based systems because of its cadmium-based technology, which they feel could lead to environment concerns over time.

- Deutsche Bank resumed coverage of Banco Santander (NYSE: STD) with a Buy rating. The firm is positive on the bank’s agreement with ABN Amro (NYSE: ABN) and feels the company has a lack of exposure to risky assets.

- Jefferies believes Internap (NASDAQ: INAP) is well-positioned with its suite of services to address a rapidly growing market, starting shares off with a Buy rating and $20 target.

- Nollenberger believes NetGear (NASDAQ: NTGR) provides a pure-play opportunity to capitalize on the global penetration of broadband connectivity. The firm resumed coverage with a Buy rating and $36 target.

OTHER INITIATIONS:

Permalink | Email this | Linking Blogs | Comments

Share This

No Comments » No Comments »

Filed under: Competitive strategy, Google (GOOG), Apple Inc (AAPL), Berkshire Hathaway (BRK.A), Personal finance, Intuitive Surgical Inc (ISRG)

One of the most misunderstood aspects in the investing world is investors getting hung up on the price of a stock. Don’t get hung up on the actual price of a stock — it’s the market capitalization that is the critical piece of data.

I have heard hundreds, if not thousands of times, I won’t pay $500 a share for Google (NASDAQ: GOOG) or $160 a share for Apple (NASDAQ: AAPL) or $200 for Intuitive Surgical (NASDAQ: ISRG), blah, blah, blah. I have news for those investors that don’t get it: the price is irrelevant. Google, Apple or Intuitive Surgical are all strong buys because of superior fundamentals and superior growth rates. Whether Google is $660 or $32; if it splits the shares 20 for 1 — does it matter? In theory no; in practical terms, a little bit.

Individual investors (and some institutional money managers as well) feel better buying a $32 stock than a $660 stock. It is purely psychological … or is it? Why doesn’t Google split its shares 20 for 1? The reason is a split increases the share count and makes it easier to “borrow” shares for short-sale purposes. The smaller share count can be discouraging to short sellers as it is tougher to borrow shares, but also, upon “buying-in” the shares to cover a short, the stock can be driven up faster and harder.

For example, Google has 232 million shares outstanding. If Google split its shares 20 for 1, there would be 4.6 billion shares outstanding. The ability to short the shares would be much easier as the share count would make it easier to borrow. But with only 232 million shares, it is a tougher transaction to achieve.

Companies like Google, Apple and Berkshire Hathaway ( NYSE: BRK.A) desire loyal, long-term shareholders and want to discourage traders in their respective shares. Traders and short sellers will avoid, or at least attempt to avoid, names like these. They are purposely tougher to trade around and do attract longer term holders.

So, remember, get hung up on the market cap and / or the PE (price -to-earnings) ratio, or some other relevant metric, just not the ,stock price. Google by the way, trades only at 32 times 2008 earnings estimates of $20 per share. Some feel this is cheap! By the way, Berkshire Hathaway’s share price is $126,400 per share — cheap at a 16 PE multiple. The earnings expectations are at $7.820 PER SHARE. Again, cheap!

Georges Yared is the CIO of Yared Investment Research and the author of “Baby Boomer Investing…Where do we go from here?”

Permalink | Email this | Linking Blogs | Comments

Share This

No Comments » No Comments »

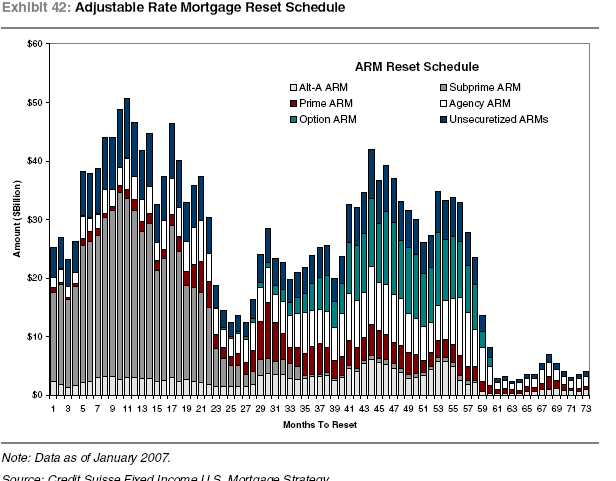

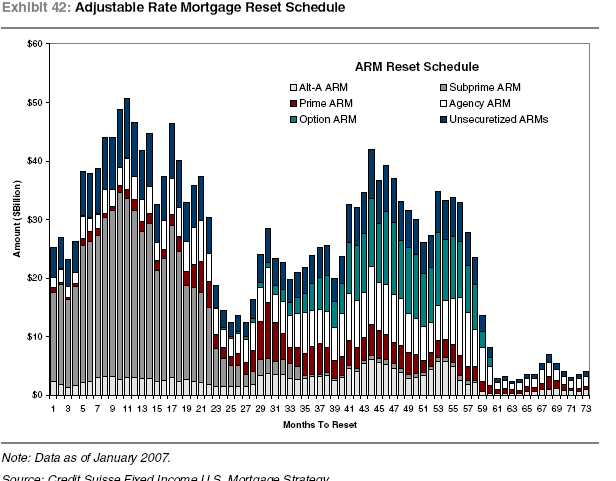

You really have to pause when you hear certain housing pundits state lucid thoughts such as, “we never saw this mortgage mess coming” or “all indications pointed to a stable market.” Just like earthquakes sometimes give way to tsunamis out in the ocean, we’ve had a window of warning that this mortgage mess was going to happen. So what did people do in the housing industry with this information? They simply rolled out the beach blanket, opened up the picnic basket, and idly stared at the quite ocean expecting that the oncoming tsunami would somehow stop by serendipity. Even in January, I’m sure all of you have seen the chart below at some point in the past year, we have a near perfect picture of what was going to happen in the mortgage markets. Instead of scaling back lenders stepped it up a notch and started funneling even more absurd mortgages. In fact, Countrywide in May of this year was talking about 50 year mortgages, expanding their subprime unit, and even adding 2,000 jobs! Of course they will soon take the axe to about 10,000+ people. Even an amateur economist can see with this chart that a mild pull back in housing prices was going to lead to what we are now living through:

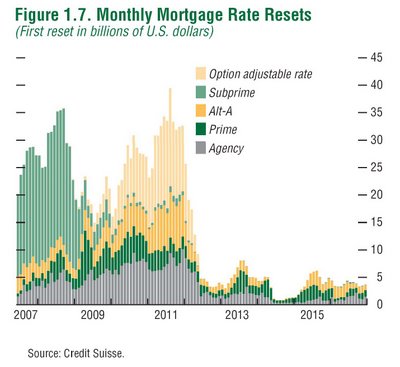

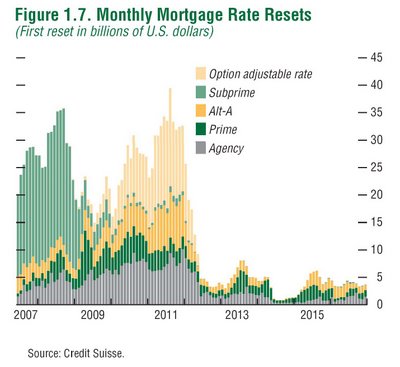

We are only in first stages of this mortgage mess. We are point 10 on the horizontal axes. We’ve all been hearing about people refinancing and getting out of these risky mortgages trying to buy extra time. Well the IMF has come out with another reset chart and a fantastic paper that gives you an idea of the overall world credit markets. What does this new chart show us? Well take a look below:

First, you’ll notice that the subprime market will keep on having problems up until 2009. But an interesting new wave emerges with this new data. Now we are seeing a growth in Option adjustable mortgages; that is, mortgages where you can pay even less and have your mortgage balance grow! So clearly if you can put 2 and 2 together, many people refinanced out of toxic subprime mortgages (if they could) into option mortgages and all those late comers to the housing party substituted subprime loans for option mortgages. Jumping from one frying pan to another! An option mortgage is just as bad as a subprime loan, possibly even worse. First, these loans give you various payment options. At the bare minimum, you have the ability to pay less than the interest on the loan. How can that be? Well, any interest is simply tacked onto your balance so when your mortgage fully amortizes, you will have a larger mortgage. Call it mortgage appreciation. It is another wonder of the financial engineering that we are now living through. As you can see from the chart above, this wave doesn’t fully expand until 2010 through 2012.

The two waves of the future. If we are already having trouble dealing with the ramifications of stage one of the subprime reset bomb, what do you think will happen in Q1 and Q2 of 2008 when we hit the peak subprime stages?

Share This

Share This

No Comments » No Comments »

Filed under: Consumer experience, Competitive strategy, Procter and Gamble (PG), Stocks to Buy

This post continues a series on defensive stock-picking strategies.

With the equity markets in a choppy, consolidation mode (or perhaps worse), the consumer products sector has appeal. One consumer products name worth a look: Procter & Gamble (NYSE: PG).

If General Electric (NYSE: GE) is ‘the mutual fund in one company,’ then Procter & Gamble is the ‘consumer products aisle’ in one company. Pick a brand, any brand. PG has about 300, including names you know well like Crest toothpaste, Folgers coffee, Bounty paper towels, Tide detergent, Gillette shavers. PG’s core product line contains brands that are entrenched in U.S. culture, and in U.S. consumer buying patterns.

Procter & Gamble says its mission is “to provide superior quality and value to the world’s consumers,” and both revenue and consumer satisfaction suggest it’s “on message,” to borrow a political campaign strategy phrase. To be sure, in the kaleidoscopic consumer products market, one can always find a designer/niche product — a salon-based shampoo, for example — that argues that it’s better, for a price, than PG’s product. But PG has moved forward, first domestically and now globally, confident that its products will offer more than adequate value for the typical person. That strategy has been working for, oh, about 170 years.

Continue reading Procter & Gamble (PG): Playing defense via consumer products

Permalink | Email this | Comments

Share This

No Comments » No Comments »

Filed under: Bad news, Internet, Competitive strategy, eBay (EBAY)

The questions are beginning to swirl about Skype’s future as a property of eBay Inc. (NASDAQ: EBAY) I for one think it’s high time for Meg Whitman and crew to put that lumbering ox on the butcher’s block. The latest in a long painful series of failures and foibles for the once overpriced Skype VOIP system is eBay’s recent scolding of some of it’s members for placing Jajah telephony buttons within their item listings to effectively allow the member to member communications which Skype was at one time slated to accomplish. The questions are beginning to swirl about Skype’s future as a property of eBay Inc. (NASDAQ: EBAY) I for one think it’s high time for Meg Whitman and crew to put that lumbering ox on the butcher’s block. The latest in a long painful series of failures and foibles for the once overpriced Skype VOIP system is eBay’s recent scolding of some of it’s members for placing Jajah telephony buttons within their item listings to effectively allow the member to member communications which Skype was at one time slated to accomplish.

A report by Stuart Corner of itWire states that, “According to Jajah, eBay has informed some of its users that placing Jajah Buttons on offers within the eBay marketplace is not allowed.” Apparently Jajah buttons violate a long standing eBay policy against links to live chat systems. Free communication among eBay members is discouraged. Jajah co-founder Daniel Mattes, said: “We will work on behalf of our users to ask eBay to reconsider.” I’m afraid to say that if eBay frowns upon Google shirts at their eBay live event, they’ll probably continue to stand in the way of Jajah buttons in their item listings also.

A recent Bloggingstocks post by Beth Gaston Moon points towards a brighter future for Skype based on the words of Meg Whitman. I suppose anything is possible but this blogger thinks that if eBay doesn’t unload Skype and do it quickly, they will be stuck with the world’s largest pink elephant ever. For now at least, someone with some communications savvy could take hold of Skype and still mold it into something with some mentionable growth potential. As eBay clings willfully to Skype, technology threatens to overtake Skype dead in it’s tracks in the hands of a management team which is in need of circumspect evaluation. Some people might want you to think that Skype’s revenue increase of 96% year over year is something to crow about but if you recall, for the last two years previous, Skype did about nothing for eBay’s bottom line and a 96% increase of nothing isn’t much.

Permalink | Email this | Comments

Share This

No Comments » No Comments »

Filed under: Products and services, Industry, Consumer experience, Media World

The future of the music industry seems rooted in everything but the industry. This month has certainly showed how far that reality is after Radiohead’s self-release of In Rainbows, the band’s seventh album, as an internet-only download (for the time being). But Radiohead is not the only successful band to eschew the input of the music industry. Even before Radiohead’s album became sensational news, fellow English band Oasis had announced the release of an internet-only single, “Lord Don’t Slow Me Down,” as a self-release as well.

Two examples may not seem threatening for an industry that has been around for decades, but when artists can self-release music as wide as these have been, the music industry certainly looks decrepit. A self-release always seemed to amount to nothing more than an underground tape, or a limited pressing, but with the internet and the “efficiency” it has over the music industry, that just is not the case anymore. These two examples (and many other cases not mentioned here) are important because artists do not need the industry anymore.

What remains to ask is if we, as consumers, need the industry anymore? It’s too early to give a well-educated answer to that, especially as many of the big artists are still “controlled” by the industry. This should not sound as a industry blast either, because despite the decline that seems to be occurring, the music business still offers a number of products and offers that are entertaining and wanted. At this point, we need the industry and that may never change. What will change hopefully is the way the music industry operates.

If the industry could make is all more accessible, then there would be no question between paying less for an album in ten days versus waiting three months for an overpriced CD.

Permalink | Email this | Comments

Share This

No Comments » No Comments »

Filed under: Consumer experience, Newspapers, Personal finance

I’m going to share a little story with you that could be the end of my career as an even marginally-respected financial writer. Or, perhaps, it could establish my credentials as an uber-thrifty guy. Back when I was in high school, I was walking on the beach at night and stumbled on a nice Nike sweatshirt. It had some seaweed stuck to it and was soaked from the ocean. But it was definitely my style. And so I picked it up, took it home, washed it and — voila! — a wonderful, good as new Nike sweatshirt.

It gets worse: fast forward 24 hours. I was working at a candy store in a marketplace not so far from that beach when a strapping young football player walked over to me and inquired about where I’d gotten my sweatshirt. I told him the truth and he asked if I wouldn’t mind giving it back. So I was cold that night, having just relinquished my new-found sweatshirt. My boss was standing there watching the whole thing, and actually saw fit to give me a 50 cent an hour pity raise, he said: “So you can buy your own sweatshirt!”

But in Germany, they’re taking thrift to a whole new level. I’d probably fit in well. According to The Wall Street Journal, sifting through your neighbors cast-offs while they wait for the dump-truck is considered perfectly normal — admirable even. As one man put it, “Consumption is nothing good. It brings evil into the world.”

Couldn’t have said it better myself. In any case, thrift is a wonderful thing: It saves money, keeps us out of debt, and it’s wonderful for the environment.

So now I’m not ashamed of my trash-picker ways. It doesn’t mean you’re poor or trashy: it means you’re smart.

Read | Permalink | Email this | Comments

Share This

No Comments » No Comments »

Filed under: Earnings reports, Good news, American Express (AXP)

American Express (NYSE: AXP) shares took a bit of a beating last week, dropping over 10% as financial stocks turned in one bad earnings report after another over the course of the week. The stock lost another 0.42% today as investors braced for more bad news from the financial sector as the nation’s third-largest credit card company was scheduled to announce its third quarter earnings after the closing bell. American Express (NYSE: AXP) shares took a bit of a beating last week, dropping over 10% as financial stocks turned in one bad earnings report after another over the course of the week. The stock lost another 0.42% today as investors braced for more bad news from the financial sector as the nation’s third-largest credit card company was scheduled to announce its third quarter earnings after the closing bell.

But the company delivered a positive surprise, sending shares up as much as 3% in after hours trading. Increased spending by American Express’ consumer and corporate clients boosted quarterly profit up 10% to $0.90 per share, surpassing Wall Street expectations of $0.86 per share. The company’s revenue climbed 11% to $6.945 billion, which is a touch shy of analysts’ estimates of $7.27 billion. Nevertheless, the report is viewed as positive by investors concerned that American Express would also fall victim to the credit woes that have weighed heavily on companies like Bank of America (NYSE: BAC) and Citigroup (NYSE: C), which reported higher loss ratios in their credit card businesses last week.

Delinquencies edged higher year-over-year, but were in-line with the previous quarter’s performance. American Express has dodged some of the credit problems other financials are facing now due to the company’s focus on a wealthier, more reliable customer base.

A large portion of the company’s revenues come from fees charged to merchants for transactions, called the “discount rate.” American Express CFO Daniel Henry noted that the company may cut its discount rate, which is currently 2.5%, due to competition from other major credit cards. Visa and MasterCard (NYSE: MA) charge approximately 2%, which puts some pressure on American Express, as many merchants refuse to accept these charge cards because of the higher fees. More merchants accepting the cards could potentially offset losses from cutting the discount rate, if the company is forced to go that route.

The company remains “cautious” on the economy, and increased its provisioning for potential loan losses by 25 percent to $982 million, but Henry is confident that the company is better positioned than its competitors due to its more affluent customer base.

Meg Massie is an options analyst and writer at Investors Observer. DISCLOSURE: At publication time, Meg is long AXP.

Permalink | Email this | Comments

Share This

No Comments » No Comments »

Filed under: Market matters, Mutual funds, Money and Finance Today, Personal finance

How vulnerable is your mutual fund to the ongoing mortgage meltdown? In this series, BloggingStocks contributor Lita Epstein, author of more than 20 books including Trading for Dummies and The Complete Idiot’s Guide to Improving Your Credit Score, digs into mutual funds’ holdings looking for securities with exposure to the currently shaky credit markets.

After reviewing funds from Bank of America, JPMorgan, and Fidelity, companies that have been mentioned in some of the SIV bailout stories, I looked to see if other bond mutual funds also had significant exposure to the credit markets tied to this mortgage and asset-backed securities mess. While I can’t guarantee that I located all the ones with significant exposure to this mess, here are some key players:

Eaton Vance Low Duration A has the riskiest position by far of all the ones I look at this morning. As of 04/30/07, this fund held 79.93% of its assets in mortgage pass-through securities. More than 75% of its holdings are in bonds rated BB and B. Its yield of 5.5% certainly doesn’t justify this risk. If you are holding this fund, you could find a safer bet with similar yields.

As of 9/30/2007, Credit Suisse Short Duration A held 15.43% of its assets in mortgage pass-through securities, 13.86% in collateralized mortgage obligations, and 12.82% in asset-back securities. That’s slightly more than 40% of its portfolio in the type of credit markets now showing signs of trouble.

Continue reading Mutual funds and the mortgage mess: Credit Suisse, Eaton Vance, Hartford, Principal, and Schwab

Permalink | Email this | Comments

Share This

No Comments » No Comments »

|

Sequoia Capital is a pioneer of the venture capital space, having invested in such game-changing companies like Apple (NASDAQ: AAPL), Cisco (NASDAQ: CSCO), and Google (NASDAQ: GOOG). No doubt, they’ve helped create many millionaires — and some billionaires.

Sequoia Capital is a pioneer of the venture capital space, having invested in such game-changing companies like Apple (NASDAQ: AAPL), Cisco (NASDAQ: CSCO), and Google (NASDAQ: GOOG). No doubt, they’ve helped create many millionaires — and some billionaires. ![]() and The Edgar Online Guide to Decoding Financial Statements

and The Edgar Online Guide to Decoding Financial Statements![]() .

.

.gif)

The questions are beginning to swirl about Skype’s future as a property of

The questions are beginning to swirl about Skype’s future as a property of  American Express

American Express

Entries (RSS)

Entries (RSS)